& Preserve Their Legacies

Phoenix Estate Planning, Probate, and Trust Attorneys

Pfarr & Rethore, P.C. is a boutique estate planning, probate and trust administration law firm located in Phoenix, Arizona. Our firm focuses on helping clients prepare for both the expected and unexpected changes in their lives. Our firm’s services include foundational and advanced estate planning, including trust, wills, tax planning, asset protection, gifting, probate, trust administration, and succession planning for small business.

Estate Planning

Our estate planning practice and tax planning services focus on building Life Plans for our clients. Estate planning historically has been viewed as a transaction, and rarely is a plan maintained throughout someone’s life. Instead, we view planning as a collaborative relationship, where together we make sure that your planning stays up to date with changes in your life and changes in the law. Whether you feel a will or trust based plan is suitable for you, let our Phoenix estate planning lawyers help you navigate through the myriad of choices you have as you consider your own planning. Our services also include preparation of appropriate financial power of attorney, medical power of attorney, and living will.

Business Planning

Our corporate practice focuses on the challenges facing business owners throughout the start-up, growth and sale of their business. Our services include corporate formation including limited liability companies, subchapter S and C corporations, acting as corporate counsel for both profit and non-profit companies, serving as statutory agent in Arizona, and providing corporate governance services including bylaws, annual meeting minutes, and operating agreements.

Probate and Trust Administration

Our probate and trust administration practice focuses on helping families through the difficult time after a loved one has passed away. Most people if they are lucky have little experience in handling estate matters, and do not know what to do and when. Our Phoenix estate planning attorneys help families through this difficult time ranging from identifying assets and creditors, compiling tax information to facilitating beneficiary distributions. We assist clients with the preparation of probate documents and small estate affidavits as well as guiding successor trustees about what they do need to, and faithfully exercising his/her fiduciary duties.

Practice Areas

Client Reviews

Working with this firm, and going through this unique planning process has been a very significant time in our lives, and one which we highly commended you for your efforts. Thanks for caring and spending the...

Wow, what a different experience! So this is what estate planning is supposed to be like. We appreciate your time and making the complex understandable.

Until our family began working with your law firm, we had no idea that estate planning can be such an interesting and creative process in furthering the dreams we have for our family and community.

Our Location

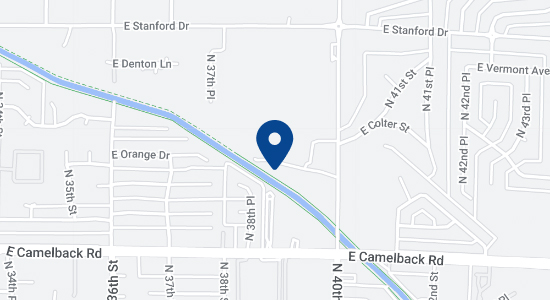

Pfarr & Rethore is located on 40th Street just north of Camelback Road. Our building, 5070, is in the office park directly across from the Capri Apartments. Once you turn into the driveway, 5070 will be the third building on the left. It is a two-story light gray building with parking in front and behind the building. There are stairs or an elevator on the south side of the courtyard to get you to Suite 230 on the second floor.

Audio Webinar

Click here to listen to a workshop that covers the basics of estate planning to help you get started on your own estate plan.

Get in Touch

Fill out the contact form or call us at (602) 424-5547 to schedule your consultation.